Unless you’re a penguin living on a deserted island, you’ve probably heard that Americans are now paying an extra 10 percent on goods imported from penguins living on deserted islands. And you probably have some questions.

1. Where are these deserted islands?

The import taxes (misleadingly called “tariffs”) apply to goods and services imported from the Heard and McDonald Islands, a small group remote islands owned by Australia in the southern Indian Ocean. The islands are 300 miles south-southwest of the nearest land (the Kerguelen Islands), 1000 miles north (lol) of Antarctica, and 2500 miles south-southeast of Antarctica.

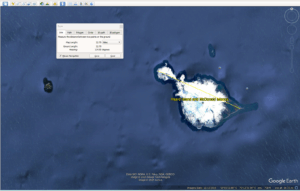

The largest island by far is Heard Island, 22 miles across. It was discovered in 1853 by the American sailing ship Oriental, captained by John Heard. Today it is claimed by Australia and has a human population of zero – not even a research station. But it is home to millions of penguins, of four different species: king, gentoo, macaroni, and eastern rockhopper. The island is an important breeding ground for all four species, and for many other species of seabirds – some of which fly thousands of miles across the ocean to meet other single birds.

2. What does the USA import from Heard and McDonald Islands?

Nothing. There are no people there.

3. So why is the USA imposing import taxes on islands with no people?

Because of the method that the White House uses to calculate the import taxes. All countries start with a base tax rate of 10 percent, modified by the equation

Δðœ = (x – m) / (ε * Ï• * m)

The term is calculated for each country with the following terms: x is the total value of all from that country and m is the total imports. The ε and ϕ are economic metrics that hilariously turn out not to matter at all: they assumed ε = 4 and ϕ = 1/4, so the two cancel out and the equation becomes:

Δðœ = (x – m) / m

All those Greek letters sure make the math look fancy, though!

Because no goods are imported from or exported to Heard and McDonald Islands, all those terms are zero and the equation is meaningless. So a stupid equation becomes even stupider, no modifications to the base rate are made, and the import tax on goods from Heard and McDonald Islands stays at 10 percent. So now, if a penguin sells you $10 worth of fish, you’ll pay $11 for it.

4. But why include deserted islands in the calculation at all?

The full list of import taxes by “country” is given in this BBC article. What the list reveals – and the reason “country” is in quotes there – is that the “countries” are not actually countries. They are top-level Internet domains. The Internet Corporation for Assigned Names and Numbers (ICANN) assigns two-letter domain extensions to each country: .fr is France, .de is Germany, and so on. Heard and McDonald Islands have the extension .hm, so they get charged an import tax. Kerguelen Island – despite being much larger and regularly visited by scientists – does not have an top-level Internet domain, so they didn’t make the list. It’s also why goods imported from la Reunion are taxes at a different rate (37%) than goods imported from France (10%), even though la Reunion is just as much a part of France as Hawaii is part of the USA.

What does this mean? It means that whoever wrote the Trump administration import tax policy doesn’t know what a country is – they only know countries by their top-level Internet domains.

5. Who doesn’t know what a country is?

Artificial intelligence doesn’t know who a country is. I have no proof one way or the other, but it sure sounds like the administration asked an AI model to design its trade policy.